The Source Magazine | Summer 2017

Posted by Breckenridge Associates Real Estate on

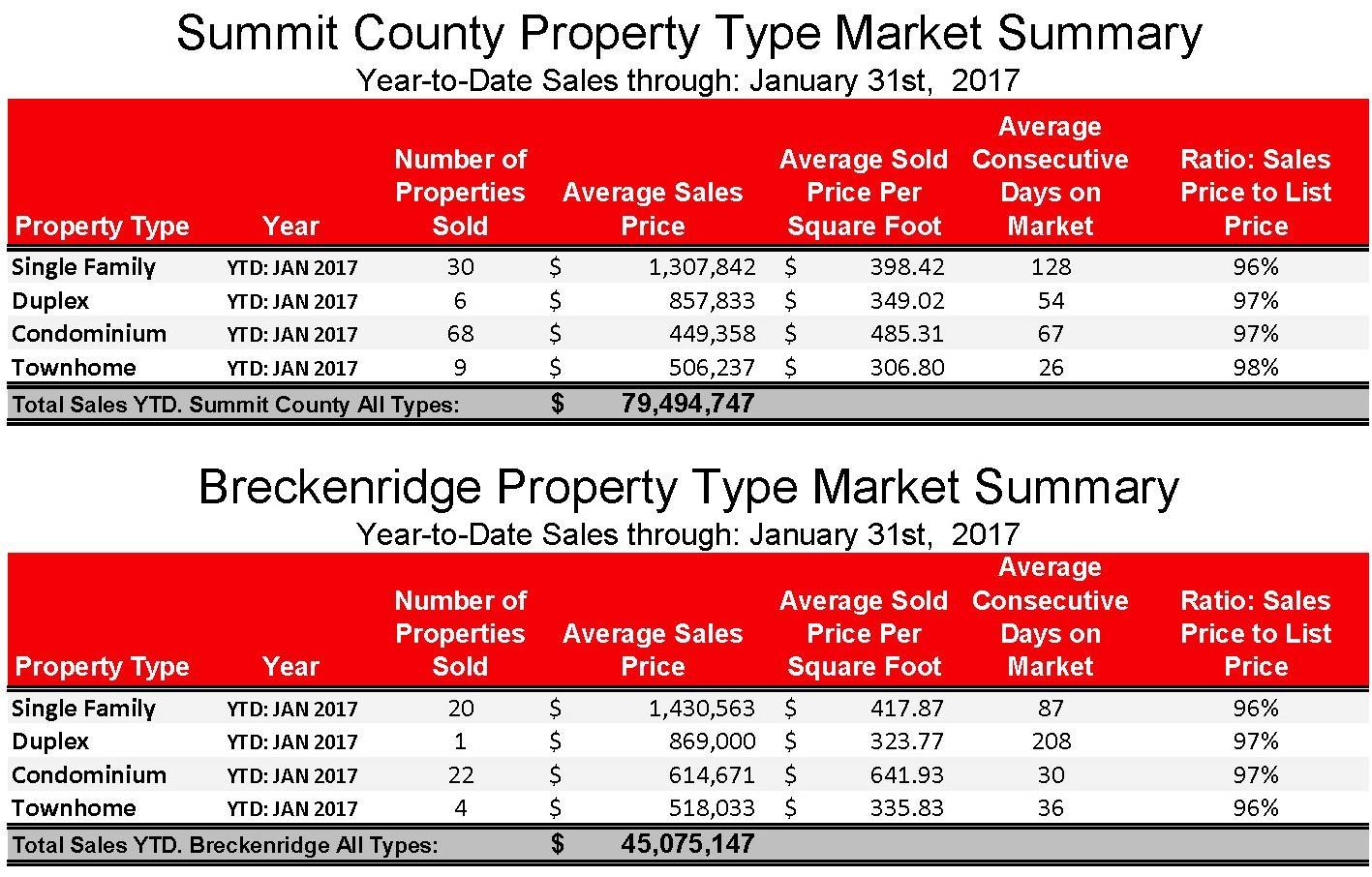

The Source Magazine is your go-to real estate information guide for Summit and Park Counties, provided by the expert team at Breckenridge Associates Real Estate. The Source Magazine will provide you with a snapshot of our current real estate listings and the real estate market in the area. Please stop by our Main Street location or call us at 970-453-2200 to meet with one of our real estate experts for up to the minute availability and to get to know our Home Town Team.

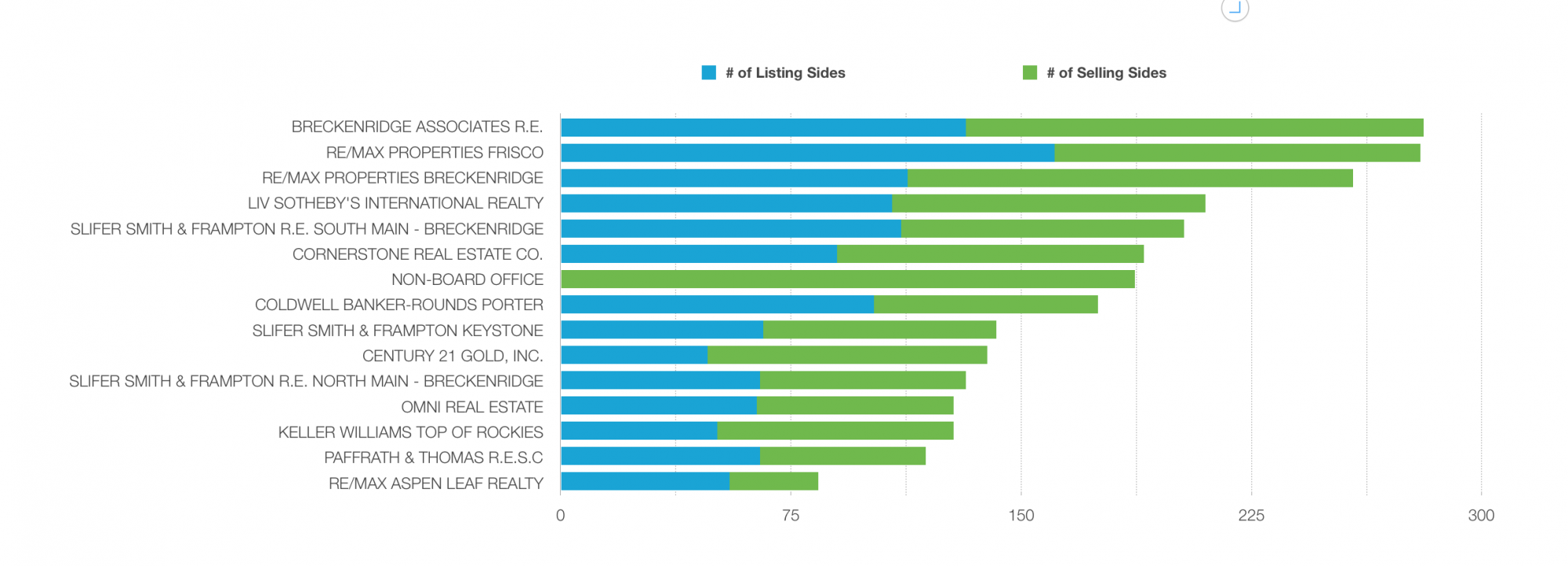

We have a demonstrable track record of commitment to our community. Our high percentage of return clients and referrals is a proud hallmark of our service. Each of our 16 Broker/Partners would be happy to help connect you with your next mountain home.

852 Views, 0 Comments